Open a Company in RA [My Experience]

UPDATED: 21.03.2025

In the RA exist differents kinds of Legal Status, you can open a LLC company or an entrepreneur Company (Sole Proprietorship)

The Process to open a Limited Liability Company or a Private Entrepreneur is Straightforward i can usually be done the same day or takes up to 3 days Maximum.

Comparaison of Advantages and Disadvantages to open your Business in RA :

SOLE PROPRIETORSHIP (RECOMMANDED) :

* Cost Only 3000 AMD Services Fees to register it (around 7 EUR)

* Easy Setup the same Day or up to 3 Days.

* Easy Process, you just need a Passport and a Notary translation of your Passport in Armenian Language.

* Easier Bank Opening than a LLC, Bank ACBA, EVOCABANK and others can open an account without a Residence Permit.

* Cheaper Accounting cost, start from 30 EUR Per month up to 60 Eur.

* Turnover Tax of 5% applies on your sales (Example : you sale for 1 000 000 AMD you pay 50 000 AMD), There is no VAT if you stay under the Threesold.

* Easy Residency, you can apply for a 1 year Residency Card or 5 years Permanent Residency.

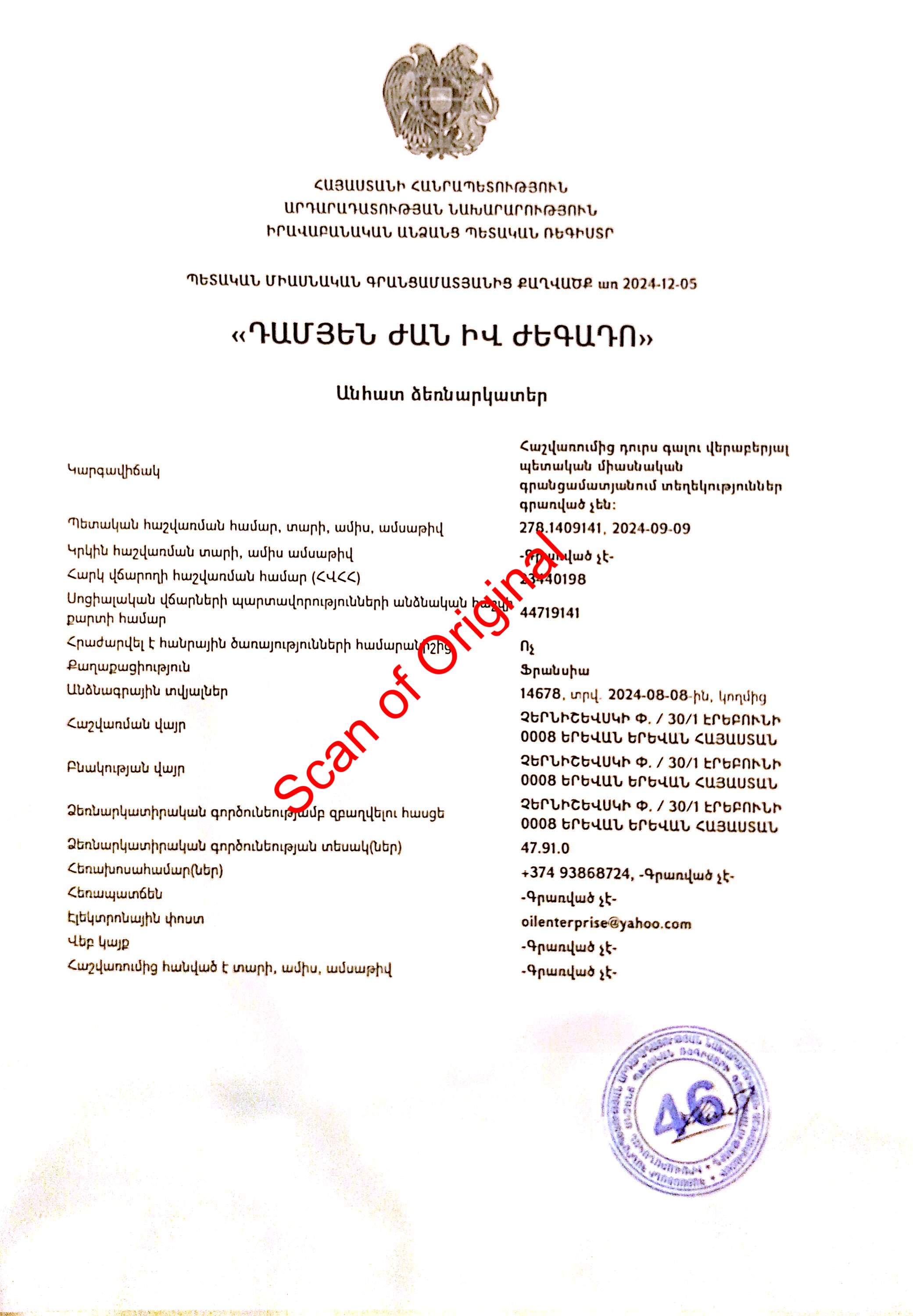

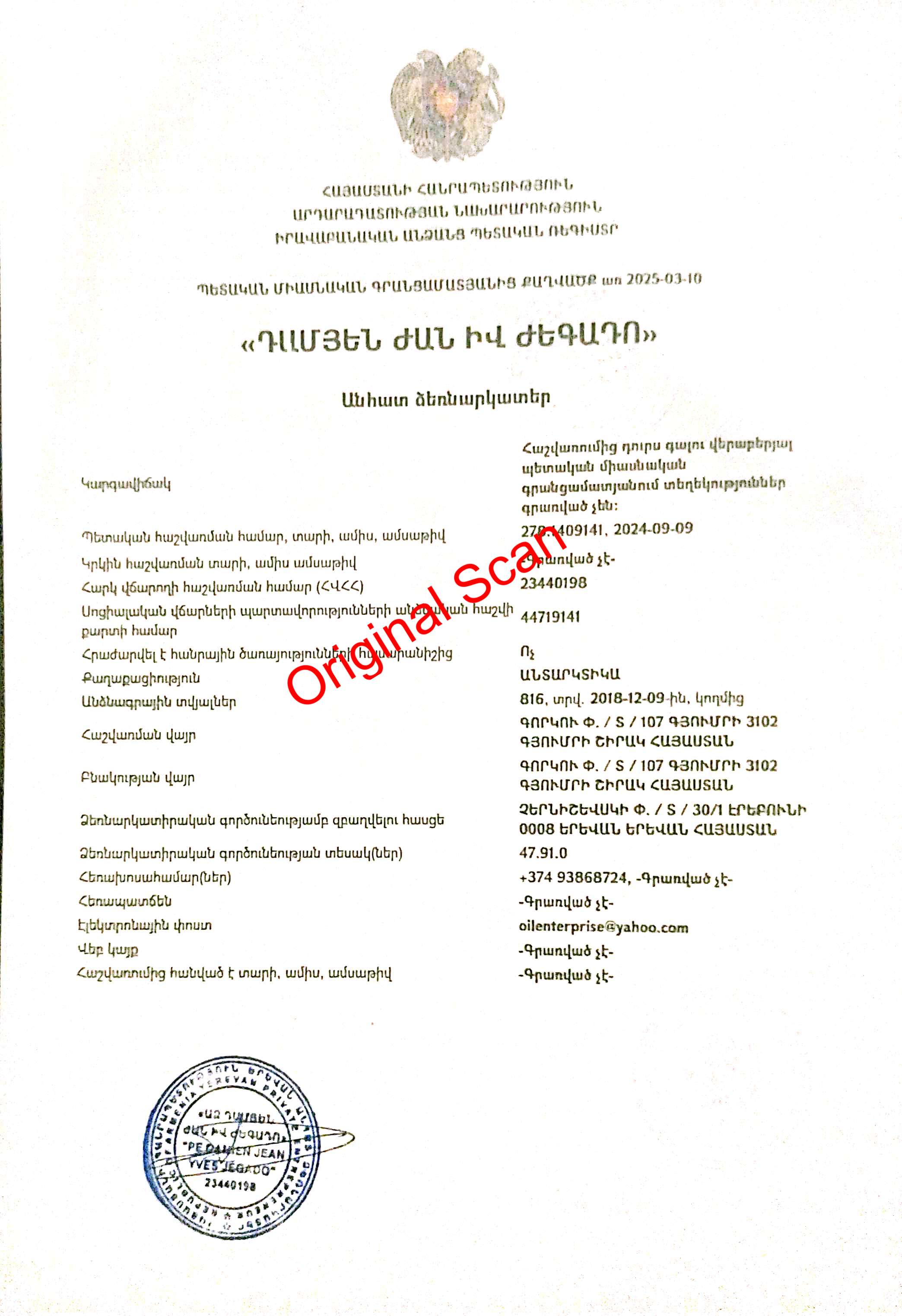

I personnaly open and registered my Own Individual Entrepreneur in Yerevan, RA during 30 Minutes and it cost me only 3000 AMD (7 EUR), i also got a Stamp for 7000 AMD (17 EUR), and were able after Some difficulty's to get a Social Number in the Passport and Visa Office of the Police, Social Number is very useful for living in Armenia. Now i am registered as an Individual Entrepreneur under the Tax Number 23440198 and can conduct FREELY almost all kinds of Commercial Operations in the RA and Outside RA.

LIMITED LIABILITY C OMPANY :

OMPANY :

* Cost Only 00 AMD Services Fees to register it (Free of Charge)

* Easy Setup the same Day or up to 3 Days.

- Difficult Bank Opening, Often Bank Require a Residence Permit or/and long term leasing contract.

* Easy Process, you just need a Passport and a Notary translation of your Passport in Armenian Language.

- Expensive Accounting, start from 90 EUR Per month up to 150 EUR (Double price if to compare with a Private Entrepreneur)

* There is a Tax of 20% applies on your profit (Example : you get 1 000 000 AMD of yearly profit and pay 200 000 AMD), There is no VAT if you stay under the Threesold.

- You Must nominate a General Director and Pay him a Salary and pay tax on this salary according the Armenian Standards.

* Easy Residency, you can apply for a 1 year Residency Card or 5 years Permanent Residency.

Where to open the Company in RA:

You can open your company online if you have an electronic signature from Armenia, or you can do it at the Central Office for Company registration in Yerevan.

https://e-register.am (official site for company registration)

You can also visit the office for company registration at the Register of Company (desk 12, 13)

3 Vazgen Sargsyan Street, Yerevan 0010

EXAMPLE OF EXPECTED RESULT: Registration Certificate

Previous and Updated Regitration Certificate, due that one of my Antarctica Passport were Stolen during my Trip from Georgia to Armenia,

Hits: 757